Understand How Bitcoin Manages Trust, Security, And Currency Flow Traditional currencies rely on central banks to issue money, control interest rates, and manage inflation. In contrast, Bitcoin eliminates the need for a central institution. Instead, the system operates through software and shared rules, removing government control entirely. This difference creates significant implications for users. Bitcoin’s […]

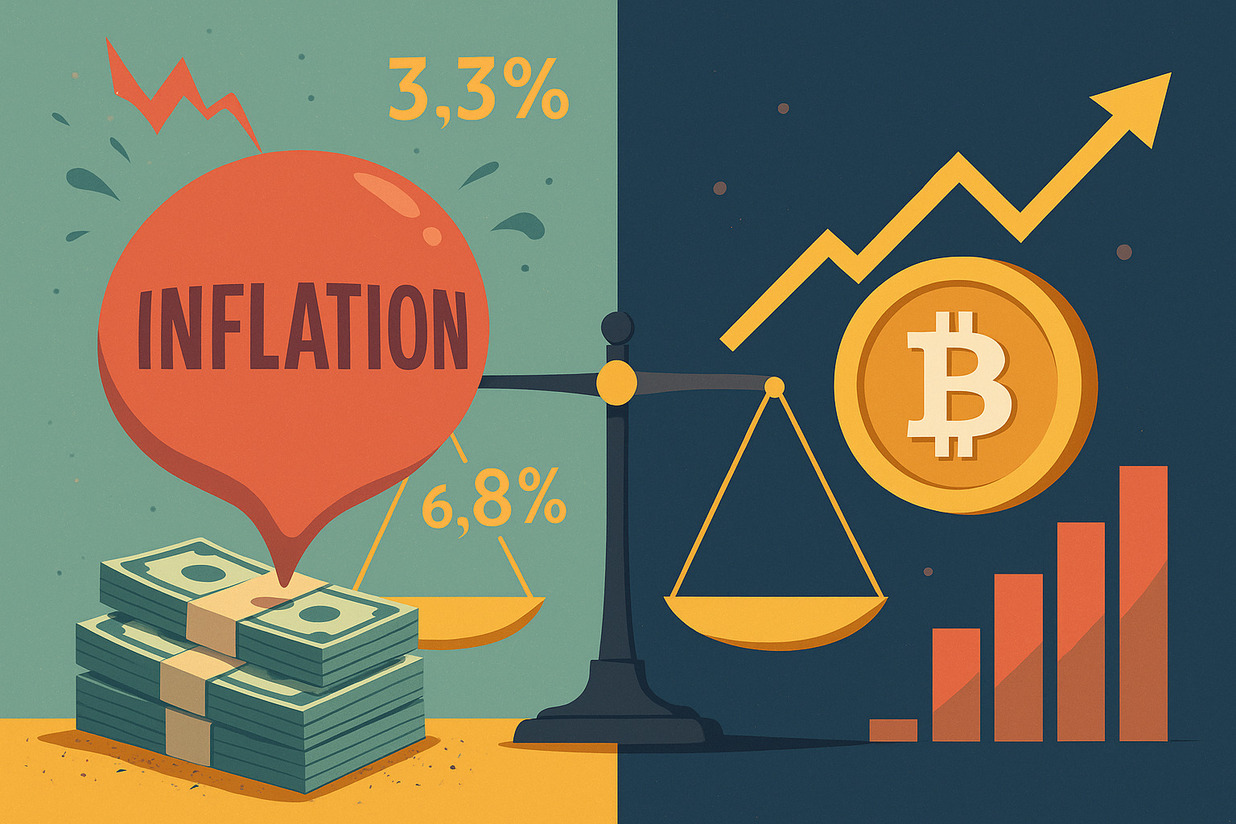

What Makes Bitcoin Different From Traditional Currency Most forms of money can be printed or created in large quantities by governments. If a country faces financial pressure, its central bank may decide to issue more currency. While this adds short-term liquidity, it can reduce the value of the money already in circulation. Bitcoin doesn’t work […]

Why ROI Calculators Matter for Bitcoin Investments Bitcoin remains one of the most dynamic and widely discussed investment assets, attracting both long-term investors and short-term traders. Given its high price fluctuations, measuring profitability is essential for anyone looking to navigate the crypto market successfully. One of the most effective ways to do this is by […]

Understanding the Value of Bitcoin Amid Rising Prices As prices of goods continue to climb, many people are looking for ways to protect their money. It’s not just about saving—it’s about where to safely store the value of your hard-earned income. This leads to questions about Bitcoin—a digital asset often compared to gold when it […]

Why It’s Important to Learn How to Send and Receive Bitcoin As the number of cryptocurrency users—especially Bitcoin—grows, so does the need to know how to use it safely and correctly. For beginners, the idea of sending or receiving Bitcoin may sound technical. In reality, however, it’s simple and straightforward once you understand the proper […]

Understanding Your Reason for Buying Bitcoin Buying Bitcoin isn’t just about entering a new type of asset. For some, it’s an investment. For others, it reflects a belief in an alternative financial system. Whatever the reason, it’s important to be clear on why you’re buying. Many regret their decision not because they bought Bitcoin—but because […]

How addresses function behind every Bitcoin transaction Each Bitcoin wallet address serves as a destination for sending or receiving digital currency. Much like a home address used by a post office, funds can’t be received unless there’s a clear, accurate location. In Bitcoin, this address is the unique identifier for your wallet on the blockchain […]

The Role of Miners in Operating the Bitcoin Network Bitcoin is a digital currency that operates without the control of any bank or government. Instead, it relies on a network of computers to maintain security and process transactions. Miners play a crucial role in this system, as they verify each transaction before it is officially […]

The Need for Converting Bitcoin to Fiat Bitcoin and other cryptocurrencies have reshaped financial systems by providing decentralized, borderless transactions. However, despite the increasing adoption of digital currencies, traditional fiat currencies such as the US dollar (USD), euro (EUR), and British pound (GBP) remain widely used for daily financial transactions. Many individuals still rely on […]

What Is the Difference Between Bitcoin and Traditional Money? Money has gone through numerous transformations, from the barter system to the use of physical cash and now, to digital currencies like Bitcoin. Traditional money, or fiat currency, is issued and regulated by governments. It is used in daily transactions, exists in physical forms like paper […]