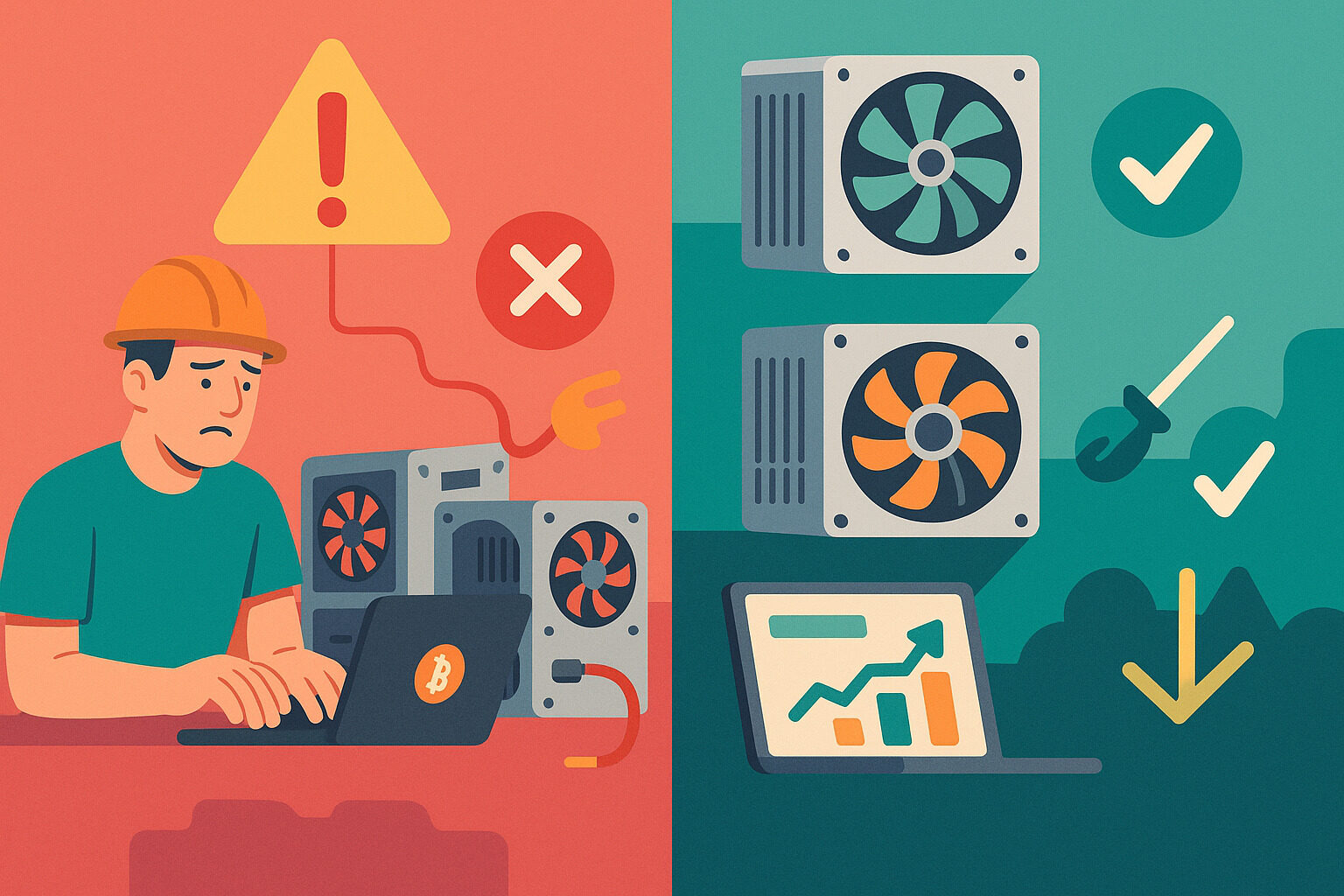

Choosing the Wrong Hardware for the Job

Starting off with the wrong equipment can cost more than just money. Bitcoin mining requires specialized machines known as ASICs. These devices are built for one thing—solving complex equations that support the Bitcoin network. Trying to use a regular computer or outdated miner often leads to wasted electricity and little to no rewards.

Some people rush into mining with secondhand gear they find online. It may seem cheaper upfront, but older models consume more power and offer lower performance. This often results in paying more on electricity bills than the bitcoin earned in return.

Doing a bit of research before purchasing hardware makes a big difference. Checking the energy efficiency, hashrate, and lifespan of different models can help miners pick the right one for their needs and budget.

Ignoring Electricity Costs and Local Rates

Electricity is one of the biggest ongoing costs in bitcoin mining. If the price per kilowatt-hour is too high, it can wipe out potential profits fast. Miners who don’t calculate this beforehand often find themselves losing money even if their machines run around the clock.

Some regions offer cheaper power, especially if it’s sourced from hydroelectric or renewable energy. Others might have time-of-use pricing that changes throughout the day. Skipping these details often leads to bill shock at the end of the month.

Using tools like mining profitability calculators can give a clearer picture. Entering local electricity rates and hardware specs into these tools provides a more accurate estimate before diving in.

Overheating and Poor Cooling Setup

Mining equipment generates a lot of heat, especially when running 24/7. Without proper cooling, machines can overheat and shut down—or worse, suffer permanent damage. Many new miners underestimate how hot these devices can get.

Using basic fans or air conditioning may not be enough, especially in enclosed spaces. A small room with several miners can quickly turn into an oven if ventilation isn’t planned. Some miners install ducting systems or place their rigs in garages or basements with better airflow.

Heat isn’t just a comfort issue—it directly affects performance. Devices that stay cooler tend to last longer and maintain a stable hash rate, which is essential for steady earnings.

Skipping Regular Maintenance and Cleaning

Dust buildup is a silent killer in bitcoin mining. Over time, fans and vents can clog, reducing airflow and causing hardware to heat up. Without cleaning, even a brand-new miner can slow down or break completely.

Some owners forget to check their rigs for weeks or months, assuming everything is fine because the screen shows a hash rate. But internal components might be suffering quietly, leading to unexpected shutdowns or reduced output.

Setting a monthly cleaning routine using compressed air or small vacuums helps. It’s also wise to inspect cables and plugs during these checkups, as loose connections can lead to intermittent performance or data loss.

Joining the Wrong Mining Pool

Mining alone has become almost impossible for individuals. That’s why most miners join a pool—a group of users who share computing power and split rewards. But not all pools operate the same way. Choosing the wrong one can lead to lower payouts, hidden fees, or even delayed payments.

Some pools may charge high fees for access or provide inconsistent reporting on earnings. Others might go offline unexpectedly, causing wasted work hours. Smaller pools might offer higher potential rewards but come with longer wait times between payouts.

Before joining, it helps to compare pool reputations, payout structures, and user reviews. Reliable pools offer clear stats, fair splits, and transparent fees.

Misjudging Network Difficulty and Trends

Bitcoin’s mining difficulty changes roughly every two weeks, adjusting based on how much total computing power is on the network. New miners often forget to account for this, expecting steady earnings that don’t match reality as competition increases.

This shifting environment means that even efficient setups may see a drop in output over time. If a miner isn’t tracking these changes, they might get caught off guard when profits dip.

Following community updates and blockchain data can help miners stay informed. Adjusting expectations and strategies along with network trends helps keep mining efforts aligned with actual returns.

Poor Wallet and Key Management

Earning bitcoin is just one part of the process—keeping it safe is just as vital. Some miners leave their earnings on pool websites or exchanges, exposing themselves to risks if those platforms get hacked or shut down.

A better approach is transferring mined bitcoin to a secure wallet. Cold storage options, like hardware wallets or paper backups, reduce exposure to online threats. This protects not only daily rewards but long-term savings.

It’s also important to back up private keys and recovery phrases. Without these, access can be lost permanently if the device is damaged or stolen. Managing security from day one avoids heartache later.

Underestimating the Noise and Space Required

Bitcoin miners are loud—often reaching the sound level of a vacuum cleaner or hair dryer. New miners who set up rigs in living areas quickly realize the constant hum can be hard to live with.

Space also becomes a factor as miners scale up. A single unit might fit on a desk, but running multiple machines requires shelving, power outlets, and safe storage. Without planning, setups can grow messy or unsafe.

Some users dedicate outdoor sheds or unused storage rooms to avoid these issues. Thinking ahead about where and how to house equipment can save time and reduce stress in the long run.

Failing to Monitor Performance Regularly

Set-it-and-forget-it doesn’t work well in bitcoin mining. Systems crash, fans stop working, or updates cause issues. If a miner isn’t watching their performance daily, they might miss hours—or days—of lost activity.

Mining software usually includes dashboards with graphs and alerts. But these tools only help if someone is checking them. Ignoring warning signs can lead to bigger problems down the line.

Setting up email or mobile alerts can help catch problems early. Even spending five minutes a day reviewing metrics makes a big difference in keeping operations smooth and steady.

Missing the Bigger Picture of ROI

Mining can feel exciting, especially during bitcoin price surges. But without a clear view of return on investment (ROI), it’s easy to overspend or burn out. New miners sometimes buy expensive gear or lock into long contracts without fully understanding how long it will take to break even.

ROI isn’t just about hardware cost. Electricity, cooling, maintenance, and time also matter. If mining becomes a financial drain rather than a source of income, it may not be worth continuing.

Careful tracking of expenses versus earnings helps with smarter decisions. When approached like a business instead of a hobby, mining becomes more sustainable and rewarding over time.

No Responses