Understand How Bitcoin Manages Trust, Security, And Currency Flow

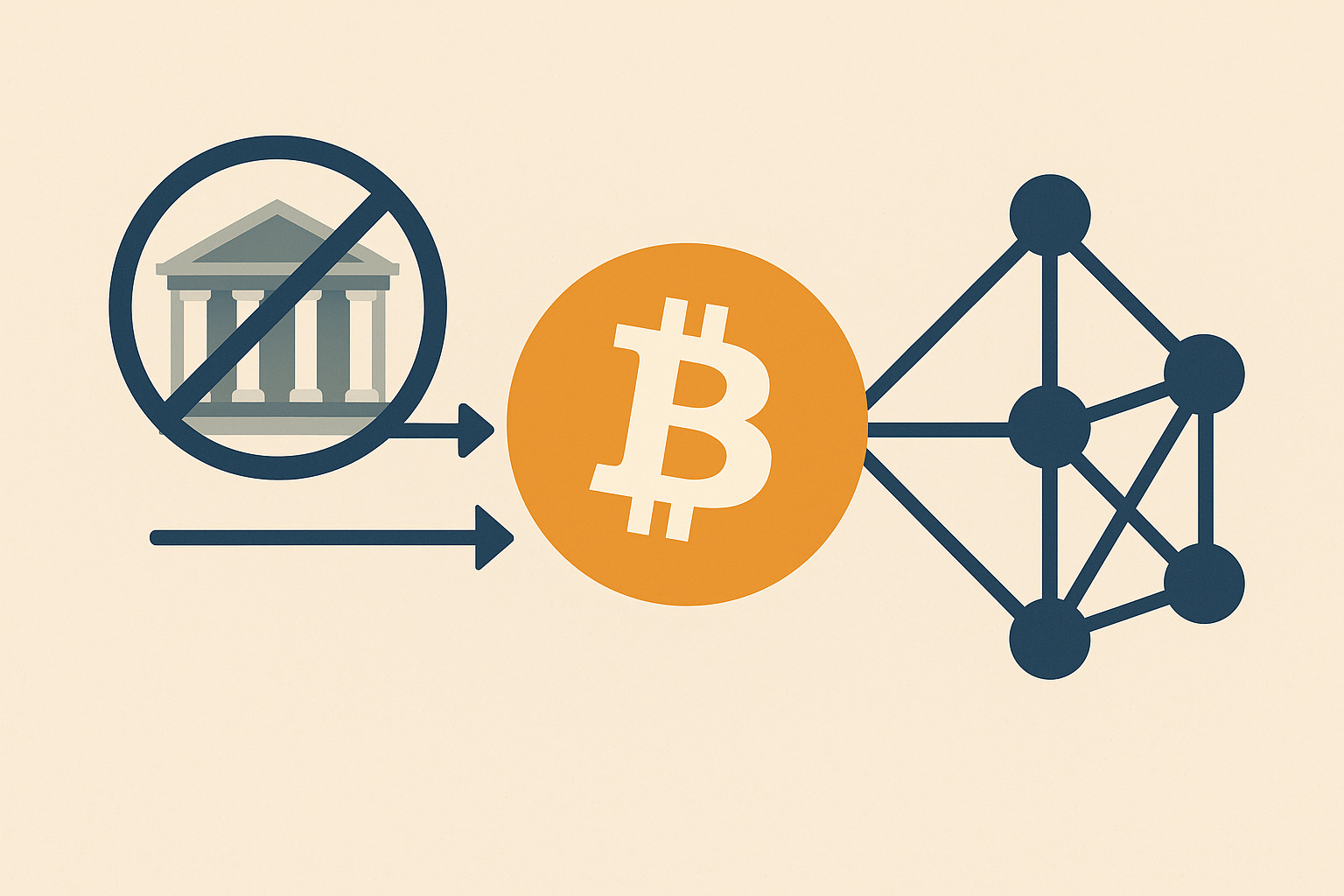

Traditional currencies rely on central banks to issue money, control interest rates, and manage inflation. In contrast, Bitcoin eliminates the need for a central institution. Instead, the system operates through software and shared rules, removing government control entirely.

This difference creates significant implications for users. Bitcoin’s structure eliminates middlemen and gives individuals full control over their funds. Moreover, transactions occur directly between users, while the code manages everything—from supply to security. Because of this independence, many people choose Bitcoin as an alternative to traditional financial systems.

Although money without a central issuer may seem risky, Bitcoin’s design makes it viable. It functions through mathematics and consensus rather than policies or printing presses. Consequently, this model transforms how money moves and redefines who holds financial control.

The Role of Blockchain in Decentralized Finance

Bitcoin relies on a public ledger called the blockchain to track every transaction, and anyone can view this ledger online. Whenever someone sends bitcoin, the system records the transaction in a block and then adds it to the chain. As a result, the entire process remains transparent and easy to verify.

Each block stores details such as the sender, receiver, and transaction amount. Cryptography protects this information, preventing anyone from altering it after confirmation. Once the system adds a transaction to the blockchain, it becomes a permanent and publicly accessible record.

Because everyone shares the same ledger, the system eliminates the need for a central authority to approve payments. The blockchain functions as both a record keeper and a rule enforcer. It guarantees that no coins are spent twice and ensures that no account transfers more than its actual balance.

How Consensus Replaces Central Approval

In traditional banking, central institutions confirm whether a user has enough funds before approving a transfer. However, Bitcoin replaces that centralized approval with a network-wide agreement system called consensus. Instead of relying on a single authority, thousands of computers work together to reach a decision, ensuring a decentralized and transparent process.

These computers, called nodes, strictly follow the Bitcoin protocol. When someone broadcasts a transaction, nodes immediately check whether the digital signature is valid and whether the sender’s balance is sufficient. If the transaction meets these conditions, nodes add it to a list of pending entries, making it ready for further processing.

Miners then collect those pending transactions, group them into blocks, and confirm them through a process called Proof of Work. This distributed verification system enables Bitcoin to transfer value across the globe without requiring approval from any central authority, creating a trustless yet secure financial network.

Mining and the Role of Proof of Work

Without a central bank printing money, Bitcoin uses mining to create new coins. Mining also helps secure the network. It involves solving complex puzzles that require computer power. This process is called Proof of Work.

Miners compete to solve each puzzle first. The winner adds a new block to the blockchain and earns a reward in bitcoin. This keeps the network running and adds a small number of new coins into circulation over time.

Because mining is costly and competitive, it discourages fraud. If someone tried to add a fake block, they’d need to control over half the network’s power—a nearly impossible feat. This is how Bitcoin keeps its system fair without a central overseer.

The Supply Cap and Monetary Policy by Code

Bitcoin’s code strictly defines its monetary policy, and the system allows only 21 million bitcoins to exist. No one—not developers, miners, or governments—can change this limit because every node in the network enforces it. This built-in scarcity forms the foundation of Bitcoin’s economic design.

The system introduces new bitcoins gradually through mining rewards. Every four years, an event called the halving cuts the reward amount in half, slowing down the rate of new coin creation. This deliberate reduction helps control inflation and mirrors how precious metals like gold become harder to extract as time goes on.

Because of this fixed policy, users always know exactly how many coins exist and when new ones will enter circulation. Unlike fiat currencies, which governments can print at will, Bitcoin provides predictability. This transparency and scarcity make it attractive as a long-term store of value, appealing to those who seek stability in an unpredictable financial world.

Transaction Validation Without a Trusted Middleman

When you send money through a bank, the institution verifies the transfer and ensures the recipient receives it. Bitcoin achieves the same result without involving a trusted third party. Instead, it relies on digital signatures, network confirmations, and global transparency to guarantee secure transactions.

Every user holds a private key and a public key. When sending bitcoin, the sender signs the transaction with the private key. The network then checks the signature against the public key and verifies the balance to confirm the transaction’s validity. All these steps occur automatically through code, ensuring accuracy without human intervention.

After the network confirms the transaction, it adds the record to the blockchain, making it permanent and unchangeable. This immutability means no one can reverse or alter completed transactions. Bitcoin builds trust not through reputation or intermediaries but through cryptography and transparent technology.

Preventing Double Spending Without Oversight

One major challenge in digital money is double spending—sending the same funds twice. Banks prevent this by updating account balances. Bitcoin prevents it through its consensus mechanism and blockchain structure.

When a transaction is sent, it’s recorded in the blockchain as soon as it’s confirmed. If someone tries to spend those same coins again, the network rejects it. The earlier transaction already claimed the funds, and everyone sees that record.

The network’s full visibility and rule-based checks mean no central authority is needed to stop fraud. Every node watches for conflict, and only valid actions are accepted. This keeps the system balanced even without oversight from a single controller.

Wallets and Control Without Bank Accounts

Bitcoin wallets let users store, send, and receive money without opening a bank account. A wallet generates a unique address and a pair of keys. The user holds full control over their funds, and no one else can access them without the private key.

There are many types of wallets—mobile apps, desktop software, paper backups, and hardware devices. Each works differently, but all let users interact with the Bitcoin network directly. No need to rely on third parties to manage funds.

This level of control is powerful. It gives users freedom over their assets, especially in places where banks are unreliable or access is limited. Bitcoin’s independence shines most in environments where financial systems fall short.

The Role of Community and Open Source Development

Bitcoin doesn’t have a CEO or a central office. Instead, it’s run by a global community of developers, miners, and users. The software is open source, meaning anyone can view or propose changes to the code.

Updates go through a careful review process. Nothing is added unless a large portion of the network agrees. This decentralized approach avoids control by any single group. Instead, consensus drives improvement.

The open nature of Bitcoin invites innovation. Developers build wallets, payment systems, and other tools that run on top of the protocol. This shared responsibility replaces the need for centralized management and keeps the system evolving.

A New Kind of Financial Infrastructure

Bitcoin shows that money can work without banks. Through decentralized software, cryptography, and a shared ledger, it offers a secure and self-sustaining way to move value. Every function—minting, validating, securing—happens without a central office.

This structure gives users freedom, but it also requires awareness. There’s no one to call for password recovery or refunds. The same tools that provide independence also ask for responsibility.

Still, the model works. Bitcoin has grown for over a decade by staying true to its design. As more people adopt it and build on top of it, its future continues to unfold—one transaction at a time, without a central bank calling the shots.

No Responses